This month, let’s analyse what’s happening with home loans and look at a surprising trend among property buyers:

- Mortgage competition heating up

- What is the average loan size in your state?

- 22% of buyers looking interstate

- Why most borrowers are going variable

Lenders are competing strongly for borrowers, especially those with strong credit profiles. As a result, borrowing activity jumped 18.2% between January 2024 and August 2024, according to the most recent data from the Australian Bureau of Statistics.

During that time, owner-occupier borrowing climbed 14.9%, while investor borrowing surged 23.7% and refinancing also increased, rising 1.2%.

If you have an existing loan and have not had it reviewed in the past two years, there’s a good chance a better deal might exist, or if you are in the market to purchase, getting in touch with an experienced mortgage broker can be helpful:

- Compare loans from a diverse range of lenders

- Maximise your borrowing capacity

- Choose a strategy and loan structure that suits your personal circumstances

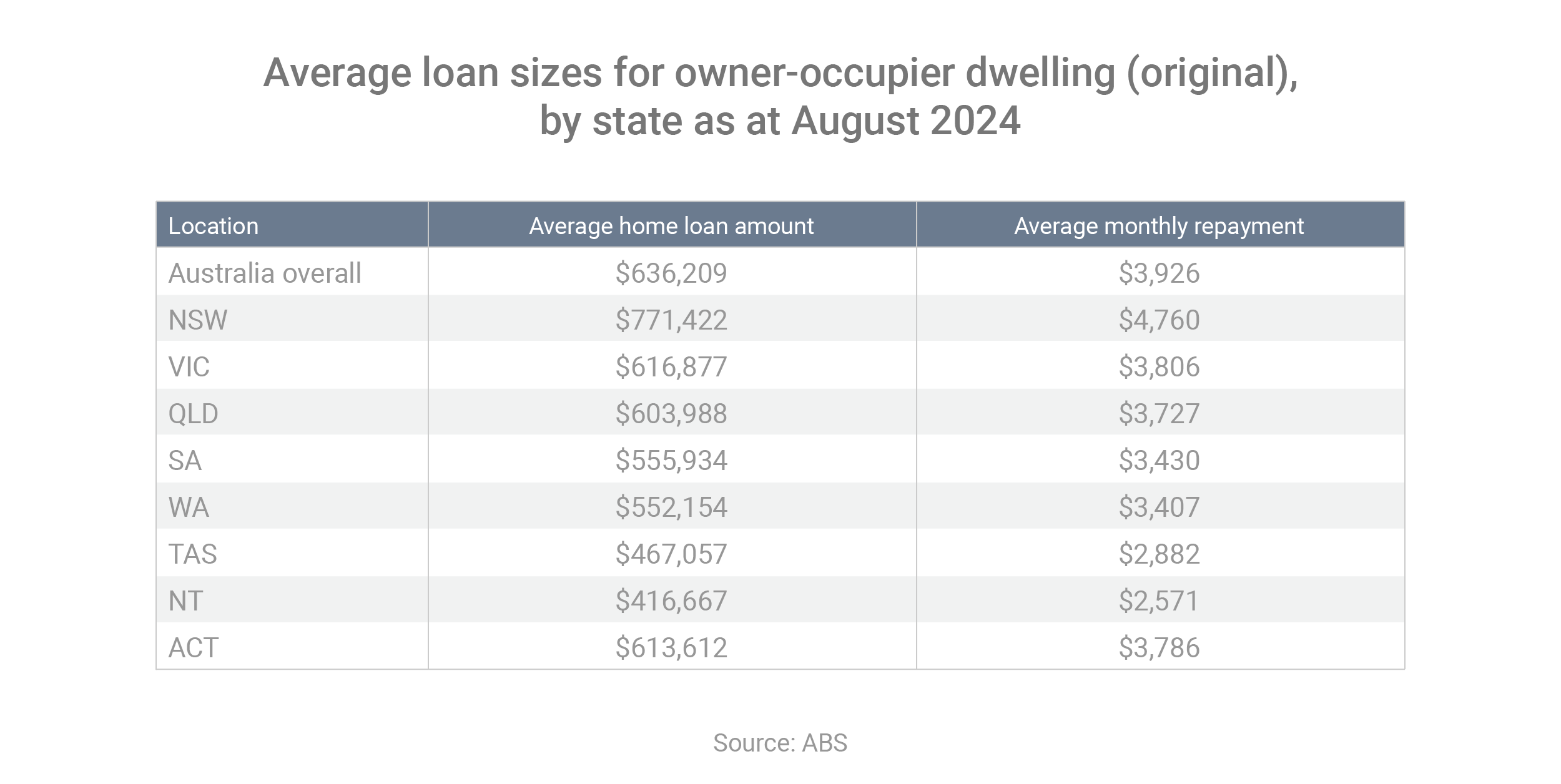

The average borrower is taking out a $636,209 home loan, with loan sizes ranging significantly in specific states, based on mortgage data from the Australian Bureau of Statistics. Check out the chart below for the figures:

Regardless of whether your mortgage is higher or lower than these figures, you probably want to reduce your loan balance. Here are some tactics to help you achieve that goal:

- Switch from monthly to fortnightly repayments – this means you’ll make the equivalent of 13 months of repayments each year

- Use your offset account or redraw facility (if you have them), to reduce your interest bill

- Refinance to a lower interest rate – there are really good deals available for borrowers who have at least 20% equity in their home

All of those things really depend on your personal circumstances and financial position – so please consult a mortgage broker who can help you run some numbers.

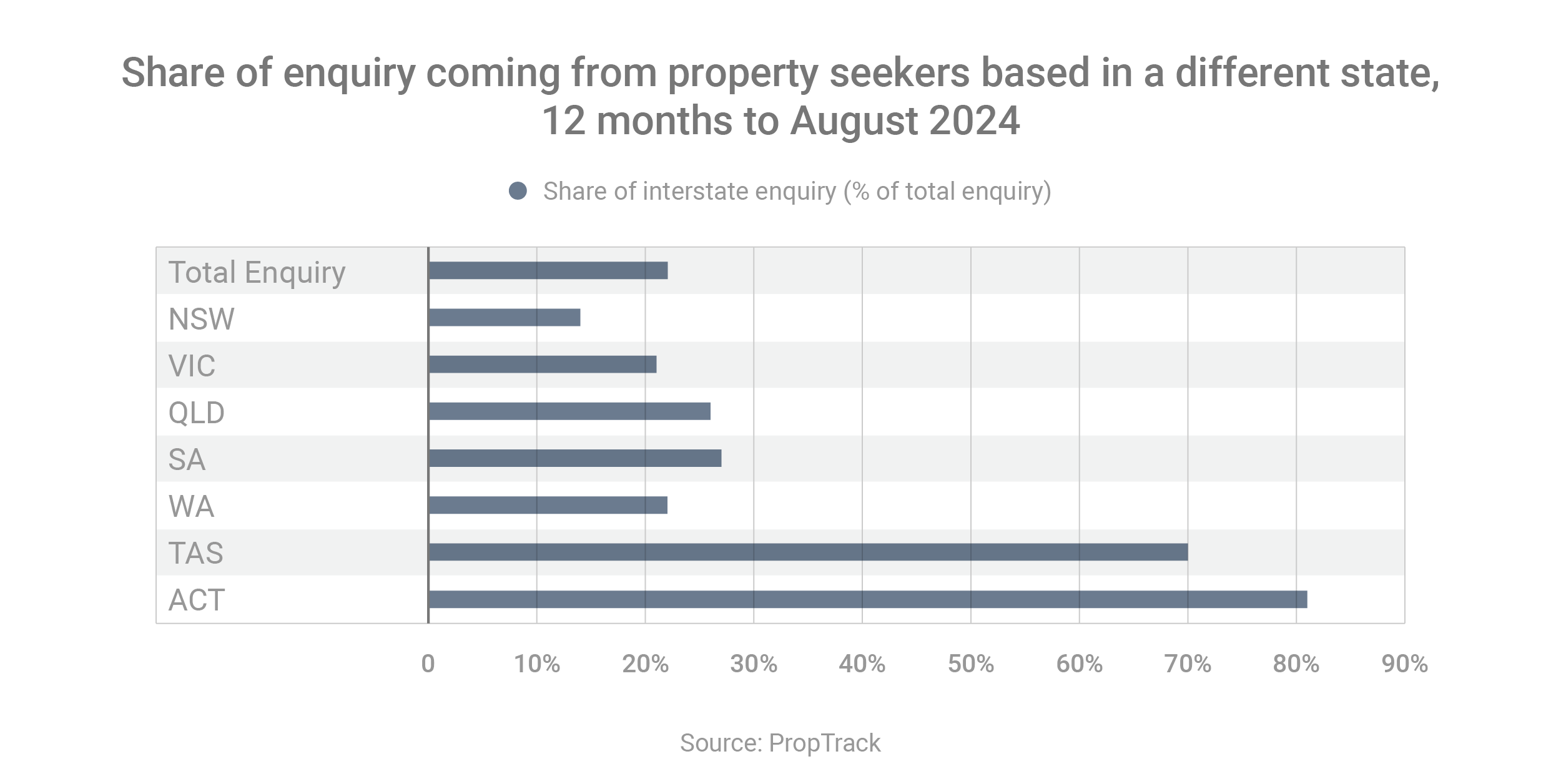

More home-hunters are looking to buy property in a different state – but why?

In the year to August, 22% of all enquiries to buy property on realestate.com.au came from buyers based in a different state, compared to 17% in the previous 12-month period.

Some people are looking to buy interstate for reasons of affordability. New South Wales, for example, which is the priciest state, recorded the highest share of local buyers making enquiries in other states and the lowest share of receiving enquiries from other states.

Meanwhile, some investors are targeting out-of-state locations that seem to offer better returns. The prime example is Western Australia – where property prices have been booming – which experienced the biggest increase in interstate enquiry over the past year.

Here are some due-diligence tips if you’re thinking about buying interstate:

- Use data to research the suburbs where you’re thinking about buying

- Order building and pest inspections of homes that seriously interest you

- Consider hiring a property manager to conduct property inspections for you or a buyer’s agent to manage the entire process for you

Finally, contact a mortgage broker for a home loan pre-approval before you start your property search, so you can get certainty around your budget.

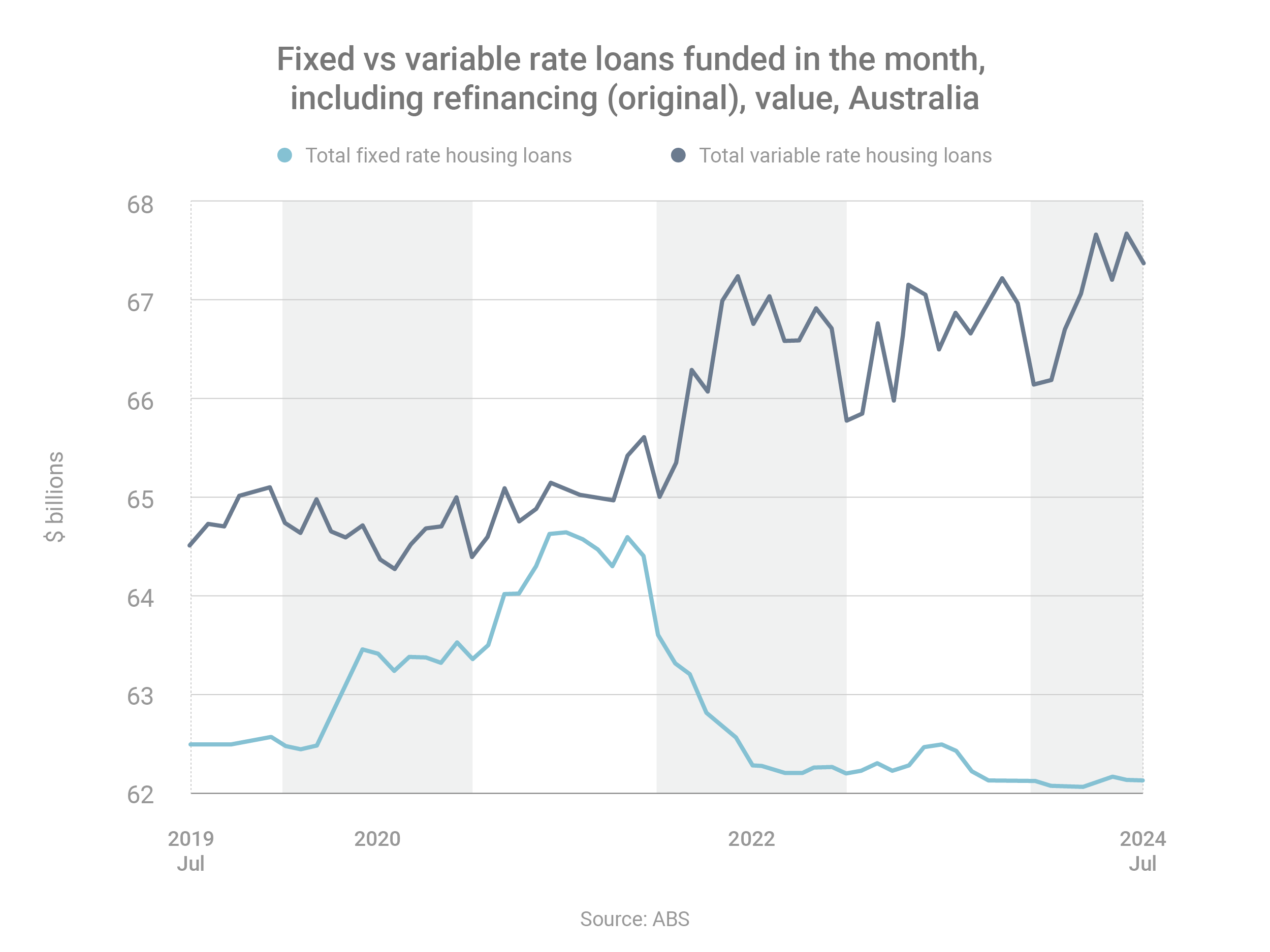

The vast majority of home loan customers are currently choosing variable-rate loans over fixed-rate loans.

In August 2024, 98% of new loans were variable, while 2% were fixed, according to the most recent data from the Australian Bureau of Statistics.

By comparison, in August 2021, when interest rates were at record-low levels, 46% of borrowers decided to fix, while 54% went variable.

Interest rate expectations appear to be guiding borrowers’ decisions.

In 2021, when rates were at ultra-low levels due to the pandemic, most borrowers assumed they would rise sooner or later – so many chose to lock in those lower rates.

Today, most borrowers assume rates have peaked, so they want a variable loan that will get cheaper if and when the Reserve Bank of Australia starts reducing the cash rate.

Fixed vs variable

- Fixed loans simplify budgeting, because your monthly repayments won’t change during the fixed period

- As a result, you won’t suffer when rates rise and won’t benefit when they fall

- Variable loans are unpredictable, because your repayments can change at any time

- Variable rates go higher when rates rise and lower when they fall

In case you want to know more or need any assistance with your mortgage, feel free to contact us. Subscribe to our newsletter for regular updates.